Now that the recession is most likely over, it's time to start looking at which companies, institutions, and individuals thrived during this grim period.

I'd like to agree, but I think this is just a media feeding frenzy, telling people what they'd like to hear. I think what we are seeing is a little good news mixed in with the bad news.

Commercial real estate has only begun to start a round of foreclosures. Unemployment isn't actually going down yet. Consumers are still overstretched, and really should be continuing to lower their amount of debt in their own enlightened self-interest.

What I see is fluctuation -- if this was the stock market, it might be called a "dead cat bounce" or a false bottom.

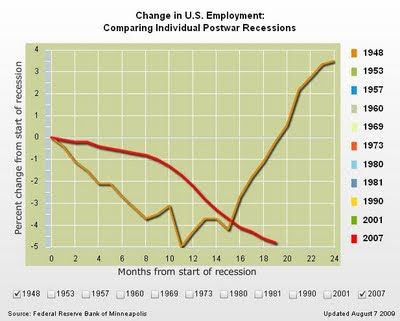

The graphs here, courtesy of the Minneapolis FRB, show show that recessions often show fluctuation: they don't just go down, then go back up. http://www.minneapolisfed.org/publications_papers/studies/recession_perspective/index.cfm

Take a look at 1948, for example. There's a sawtooth pattern to the employment picture that indicates either fluctuation or difficulty in measurement or both. The same problems can still occur now.

And yes, I do hope I'm wrong.

No comments:

Post a Comment