Just over two years ago, I posted this:

http://mikekr.blogspot.com/2009/08/recession-isnt-over.html

Newsweek thinks the recession is over. Slate thinks likewise:

“Now that the recession is most likely over, it's time to start looking at which companies, institutions, and individuals thrived during this grim period.”

I'd like to agree, but I think this is just a media feeding frenzy, telling people what they'd like to hear. I think what we are seeing is a little good news mixed in with the bad news. …Consumers are still overstretched, and really should be continuing to lower their amount of debt in their own enlightened self-interest.

…it might be called a "dead cat bounce" or a false bottom.

I wish I’d been wrong. I’m often a bit on the pessimistic side – imaging what might go wrong, so I can take steps to see it doesn’t happen – but unfortunately the situation is still pretty bad.

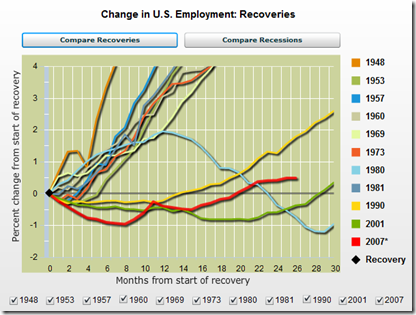

By many measures, this is the worst recession since World War II. The graph here, courtesy of the Minneapolis FRB http://www.minneapolisfed.org/publications_papers/studies/recession_perspective/index.cfm, compare various recessions:

and now we’ll compare “recoveries”, although calling the current situation a “recovery” is weak:

But wait, there’s more: note one thing in that recovery graph above. The most recent recessions (since 1980) have had much slower recoveries. Let’s look at this graph, just showing the lines since 1980:

With the exception of 1981 (or was 1980 really a double-dip recession?) these are the slowest recoveries of the postwar era. One could make up various theories about this, but (1) the shift away from a manufacturing economy and (2) the huge increase in consumer credit would seem like two obvious sea changes that might cause this effect.

Let’s consider why this would be so:

(1) Let’s consider a stereotypical manufacturing situation.

With 5 workers, you product 5 widgets in 8 hourswith 5 machines

If your demand is 10 widgets, then you need 10 workers and 10 machines to produce these in 8 hours.

Often these relationships are pretty clear to management.

In a service economy, things are less clear. A retail shop has certain minimum staffing (say, 1) but if business is slow there is 1 staffer, doing not much. You might cut hours, but that cuts business even more. Once business picks up, there may be excess capacity (less boring time for the 1 clerk), OR it may be a while before the shop owner figures the queues are too long and more help is needed.

Similarly in sales: commission salesmen may not really want more “help”. Having suffered through the recession, they’d like to have people lining up outside their offices.

Either way, there is a less clear relationship between the amount of revenue and the amount of labor.

(2) Let’s consider consumer credit. If you have savings, or home equity, then in bad times you can tap these. But if you were using these assets during the previous “boom”, you will find your credit restricted and so instead of there being assets/credit lines to tap, there’s both no home equity to tap and possibly restricted credit.

My wife and I are fortunate enough so that this has little or no effect on our personal situation, but it has a big effect on those around us. One might make a similar point about the economists who are blogging about it and the politicians who are supposed to be our leaders – THEY have jobs (often tenured jobs).

No comments:

Post a Comment